Call Center:01-9010900

24 Hours Claim Hotline:09-940777888

Call Center:01-9010900 24 Hours Claim Hotline: 09-940777888Our Company

Executive Summary

FNIG, in accordance with the insurance business law and regulations, has been accepting insurance operations since June 14, 2013 with the approval of the Ministry of Planning and Finance, Insurance Business Regulatory Board (IBRB) with the integrated insurance business license (No. 007) as FNIP, and with the general insurance business license (No. 003) as FNIG since April 1st, 2019 we have accepted the insurance business. With a company capital of 40 billion kyats and 500,000 US dollars invested, FNIG provides insurance services to the insurance industry in both Myanmar MMK and US dollars.

With 10 years of experience as an insurance company, as well as a strong management team and more than 500 professional employees with insurance qualifications, we currently accept 18 types of insurance and provide insurance services to the public.

In order to cover the whole of Myanmar and with the aim of providing easy access to insurance protection and lives in peace of mind, in addition to the Yangon headquarters, there are (3) branch offices in Yangon, as well as (13) regional offices in the provinces/regions such as Mandalay, Monywa, Mawlamyine, Pyay, Magway, Pathein, Nay Pyi Taw, Myitkyina, Taunggyi, Taungoo, Kalay, Myeik, Pyigyitagon opening and providing insurance services to all across the Nation.

FNIG is delighted to state that it has the privilege of playing a critical role in Myanmar’s social and economic reforms by ensuring peace of mind and promoting opportunities for prosperity nationwide.

FNIG provides prompt 24 hours claims services and has been gaining the reputation of effective professional claims handling.

FNIG has opened insurance agent training schools in Yangon and Mandalay, producing candidates for the future insurance world.

As FNIG strives to provide insurance services for customers, as well as for internal customers, employees who are internal customers, to fully improve their work skills and to further improve their ability to work in the field of external relations, we are creating and developing the Management Development Program (MDP) which is a program to provide necessary skills for the management field.

Protecting the people of Myanmar!

Vision

To become a leading Insurance Company in Myanmar by fostering Industrial & Economic growth as well as improving quality of peoples’ lives.

Mission

To help our customers by protecting their assets and achieve financial security with Peace of Mind.

Core values

- Integrity

- Team Spirit

- Customer Centricity

- Respect & Courtesy

- Innovation

- Dedication

Our Quality Policies

FNIG must be the first choice of a customer whenever and wherever thinking about “Peace of Mind” for his life, property and automobile etc. We always support Myanmar insurance market with special attention on the awareness about the importance of insurance system.

FNIG concentrates on canvassing business both on direct basis as well as through our agents. We have appointed qualified resident personnel in many townships across Myanmar either as branch offices or mobile teams to serve our insuring public in any way. We offer insurance solutions to the difficulties and problems of the insuring public with the acceptance of risks managed by qualified and experienced underwriters.

FNIG seeks to establish a reputation for itself as an efficient and fair insurer by meeting its claims obligations in a prompt and efficient manner. To implement this resolution, we include in our team professionals such as counsels, surveyors, adjusters etc.

We shall continually maintain and improve our efficient and quality management system, meeting both the regulatory and ISO 9001:2015 requirements.

Lines of Businesses

Through innovative product design & dedication to meet our customers’ needs, FNIG has positioned ourselves as the powerful regional insurance provider.

OUR LINES OF BUSINESS INCLUDE :

- Comprehensive Motor Insurance

- Fire & Allied Perils Insurance

- Cash in Safe Insurance

- Cash in Transit Insurance

- Fidelity Insurance

- Marine Hull Insurance

- Inland Marine Cargo Insurance

- Overseas Marine Cargo Insurance

- Travel Insurance

- Highway Express (Special) Travel Insurance

- Industrial All Risk Insurance (start from 1st October, 2020)

- Construction All Risk/ Erection All Risk Insurance (start from 1st October, 2020)

- Bailee’s Liability Insurance (start from 1st October, 2020)

- Micro Health Insurance

- Personal Accident Insurance

- Health Insurance

- Critical Illness Insurance

- Parcel Insurance

Our lines of business are not limited to these. We will launch new product lines in the near future as we move forward.

Services

We put focus on the following areas as we believe these areas are our core strengths in delivering our services:

- Identifying customer needs

- Promoting Insurance awareness

- Managing customer’s risk

- Responsive Claims Center

- Innovative Information & Technology

- Call Center

- Claim Hot Lines

- Facebook Page

- Door to Door

Our competitive advantage is that our services are prompt, and incorporate automated technology that will greatly reduce time & error in both underwriting & claim operations.

Organization Structure

Corporate Social Responsibility

- Promoting social value by providing insurance solutions to address the needs of our customers with respect to finance and health

- Spreading knowledge about insurance throughout society to encourage higher living standards

- Working to encourage the well-being of the ecosystem

- Engaging our shareholders to establish trust in FNI

- Maintaining transparency and establishing FNI as a safe place for our customers

Code of Conduct

Our code of conduct is strongly tied to our values, beliefs and based on high business ethics.

- Fairness in all areas of operations

- Anti-Corruption

- Protection of assets

- Transparency

- Good communication with stakeholders

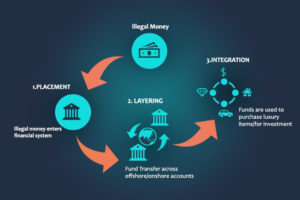

- Fraud and Crime Prevention

- Anti-discrimination

https://www.un.org/securitycouncil/sanctions/1267/press-releases

https://www.un.org/securitycouncil/sanctions/1267/press-releases SC/15916

DownLoad PDF

SC/16003

DownLoad PDF

SC/16017

DownLoad PDF

Copyright © 2025, First National Insurance.

Powered By Aceplus Solutions Co., Ltd.